Making a budget is one of the most fundamental aspects of adulthood. It’s also one of the least known. An effective budget guarantees that all of your expenses are accounted for and that you have a clear picture of where you are overspending. While setting a budget with a pen and paper is sufficient, there are budget applications that provide substantial benefits. In this post, we’ll look at some of the finest home budget apps for iPhone and iPad to create a budget and keep track of your income and expenses.

Are you an Android user too; have a look at this as well 8 Best Home Budget Apps for Android.

Home Budget Apps for iPhone and iPad

1. Fudget

The first app on the list is also one of the most straightforward. There are no complex graphs or charts to be concerned about. Simply pick a month and enter your income and upcoming spending for that month. The app displays total spending as well as the amount remaining after everything has been paid for.

If you merely want an app to keep track of your costs and illustrate how much money you spend on non-essential products, you should acquire Fudget. There are better home budget apps below if you want more advanced app graphs, forecasts, and charts.

Fudget is free to use, however, there is a paid version that allows you to export your monthly budget in CSV format and removes adverts.

Pros

- The interface that is easy to use

- Charts and graphs

- Expense report in a nutshell

Cons

- There are no custom lists or filters available.

- No Dark mode.

- There isn’t a way to make numerous budgets.

Get Fudget (free, iOS)

2. Finances

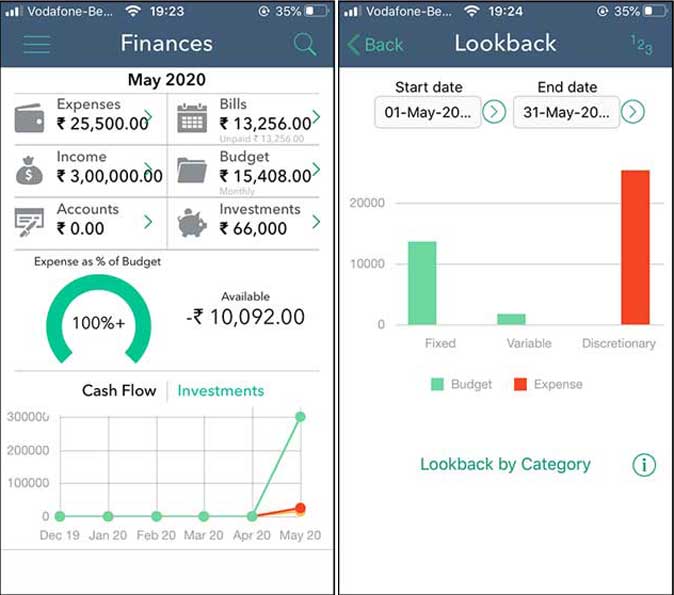

Finances home budget apps for iPhone and iPad is a little more complicated than Fudget, but it’s still straightforward software for home budgeting. Unlike other home budgeting apps, finances make budgeting simple. You just need to tap and log everything. It already contains categories for rent, utilities, groceries, and another usual spending. A specific category can be added or removed at any time.

One of the more intriguing aspects of this program is that it can forecast your forthcoming budget based on your present spending habits. You can also save the complete data set as a CSV or PDF file. Right now, it’s just available on iOS. You can set up recurring expenses, which is a benefit.

Pros

- Utilities, rent, bills, and other expenses have their own parts.

- Viewing past budgets is an option.

- Export to CSV

- Budget projections

Cons

- Model of subscription

Get Finances (free, iOS)

3. Wallet

A wallet is a useful tool that focuses on making budgeting easier. To arrange your money, you can open different accounts. For instance, you could have one account for savings and another for cash, depending on which account you use to spend. The list is automatically updated with a clear graph illustrating your spending trend as you log your expenses under a specific account.

The statistics section displays reports for up to a year, including characteristics like cash flow spending, income report, and so on. The one drawback I discovered in the app is that the budget part is tucked away in settings that can be difficult to find. However, once you’ve set up a monthly budget, the app will automatically compute your spending based on the income and costs you’ve entered.

The visual representation of your expenditure, which clearly displays your financial trends, is the app’s best selling point. You may even compare your current budget to data from the previous six months.

Pros

- Lovely design language

- Section on Statistics

- Charts that are simple to understand

Cons

- The app’s budget area is difficult to locate.

Get Wallet (in-app purchases, iOS)

4. Wally Home Budget App for iPhone

Wally is a full-featured budgeting tool for professionals. To begin, you can link your savings or checking account to the app, which will retrieve and track any transactions made with that account. It’s simple to create sub-accounts and wallets.

Even if the transactions are automatically added, you must manually enter your spending. I do, however, appreciate the ability to set reminders for upcoming invoices and spending. Always remember to pay your debts and fines. When you use Wally on a regular basis, it analyses your spending and provides important information like total spending, cash flow, balances, and even a ledger.

Wally has a slight learning curve, but once you get the hang of it, your budgeting skills will skyrocket. It’s great for customers who want a complete tool to automatically track their spending.

Pros

- Automatically input transactions by linking a savings account.

- The function of the ledger

Cons

Model of subscription

At first, it’s difficult to use.

There isn’t a way to automatically enter expenses.

Install Wally (in-app purchases, iOS)

5. Spendee

Spendee is another budget software for the iPhone and iPad that focuses on simplicity. It offers a straightforward transaction page where you can manually enter all of your spending and income.

Spendee’s selling point, on the other hand, is that it allows you to build separate budgets for each account. For instance, if you and your spouse have a joint account for domestic expenses, you can have a separate account for that and a separate wallet for personal expenses.

You may also add your spouse to a wallet so that you can report expenses together from your different phones. Spendee is a simple piece of advice for couples or even roommates who want to keep track of their finances.

Pros

- Make distinct budgets.

- Input expenses with a single tap

- Graphs and observations

Cons

- Model of subscription

Get Spendee (in-app purchases, iOS)

6. Buddy Home Budget App for iPhone

Buddy is genuinely a home budget software, as it was created with a family in mind. The first step in setting up Buddy is to build a budget. I appreciate that you can create weekly, monthly, bi-weekly, and even yearly budgets. You can even begin a budget in the midst of the month, which is a pleasant bonus. After that, you can add other people to your budget, however, unlike Spendee, this software allows you to split the expense evenly.

Buddy shares capabilities with applications like Spendee and Splitwise, but it does so in a single app, making it an appealing proposition for bachelors searching for home budgeting software.

Pros

- Any time of the month is a good opportunity to start a budget.

- The ability to design a budget that ranges from weeks to years

Cons

- Model of subscription

Get Buddy (in-app purchases, iOS)

7. Grocery Gadget

Despite the fact that I utilize a proper budget to divide my spending, one area I constantly overlook is kitchen supplies. Grocery Gadget is a budgeting app for your kitchen that helps you keep track of your costs. The app allows you to create lists for weekly grocery, pharmaceutical goods, workplace supplies, and other household products.

The OCR scanner, which can read and store barcodes, is the most user-friendly feature of this program. Despite the fact that the software recognizes many products, I discovered a few that it did not. Once you’ve made a list, you can utilize it to go shopping.

Simply scan an item that has run out of the cupboard and add it to the shopping list to limit your groceries. You’d never overspend this way, and you’d always have products on hand.

Pros

- Use a camera to scan the barcode on items.

- Make a grocery/pharmacy budget for the week.

Cons

- Model of subscription

- It’s not a full-fledged budgeting app for your home.

Get Grocery Gadget (in-app purchases, iOS)

8. Account Book

Account Book is a small business and self-employed budgeting and bookkeeping program. It contains a number of tools that allow you to keep track of your accounts, transactions, salary, and upcoming payments. You can also keep your business and personal budgets separate.

Unlike the home budget apps mentioned above, Account Book doesn’t have flashy charts and graphs, but it does the job with its detailed cost and revenue reporting. If you want to keep track of your business spending, this software is a no-brainer.

Pros

- Expenses are examined in detail.

- Budgeting at home and at work

- Alert for a pending transaction

Cons

- The user interface is both comprehensive and complicated.

Get Account Book (in-app purchases, iOS)

Read also: 7 Best Barcode Scanner Apps for iPhone

Final Verdict: Home Budget Apps for iPhone and iPad

I find these to be some top home budget apps on the App Store. You can use them to improve the efficiency of your finances. I use Wallet because it has a very user-friendly layout and makes logging transactions a breeze. What are your thoughts on these applications? Please notify me via Twitter.